Arbitrage Trading

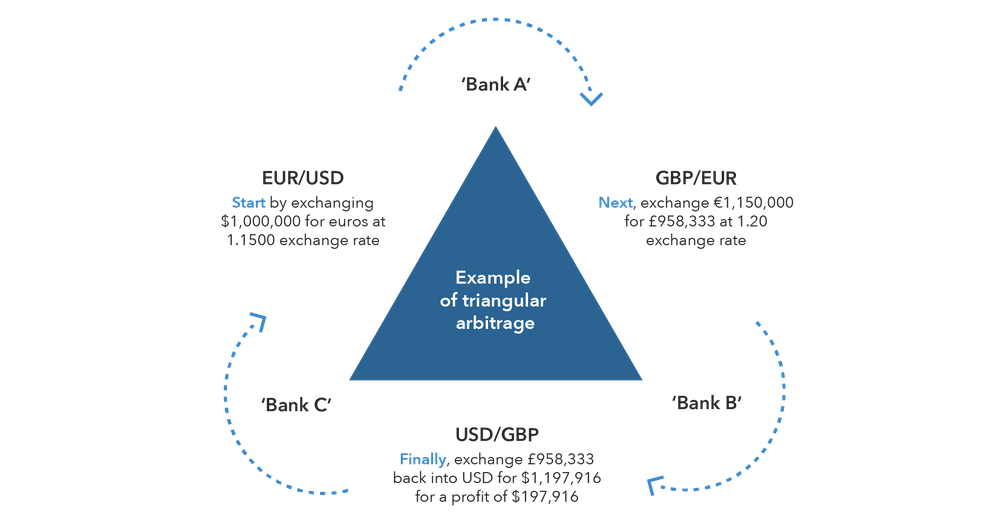

Arbitrage trading is a sophisticated trading strategy that requires a deep understanding of various markets and the ability to quickly analyze and act on market data. At our firm, we use advanced technology and proprietary algorithms to identify arbitrage opportunities in real-time, allowing us to make trades with precision and speed. One of the key benefits of arbitrage trading is that it is a low-risk or risk-free trading strategy. Since we are buying and selling assets simultaneously in different markets, we are not exposed to market fluctuations or changes in asset values. Instead, we are simply taking advantage of price discrepancies between markets to generate profit. Our team carefully selects arbitrage opportunities based on a variety of factors, including market volatility, liquidity, and trading volumes. We also conduct extensive research and analysis to ensure that our trades are executed with minimal risk and maximum profit potential.